Play Video

ABOUT HYCO

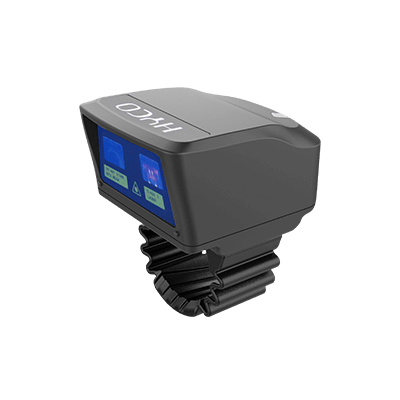

Founded in 2009, HYCO Technology Ltd. focuses on developing geek hardware for ultra-low power consumption wearable IoT devices and ultra-low carbon smart robots.

Mission:

Innovation technology empower labors safer easier and efficient work

Vision:

Global leader of ultra-low power consumption IoT platform

Fortrune 500 Clients:

DHL, Walmart, Daimler, JD, and over 20 other companies from the list

3

Standards

20+

Fortune 500 Company Clients

100+

Pantents

3

Standards

20+

Fortune 500 Company Clients

100+

Pantents